South Africa’s carbon tax covers around 90% of the country’s emissions, including those from fuel combustion, industrial activity and fugitive emissions. The introduction of the carbon tax was spurred by the country’s voluntary commitment – made at the Conference of the Parties held in Copenhagen (COP15) in 2009 – to cut emissions from its modeled business-as-usual trajectory by 34% by 2020 and 42% by 2025.

Key message

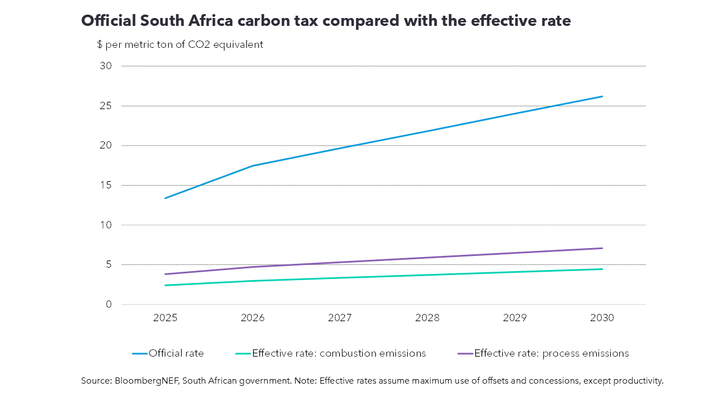

South Africa’s carbon tax, introduced in 2019, covers roughly 90% of the country’s greenhouse gas emissions. The headline rate stands at about 236 rand ($13.75) per metric ton of CO2 equivalent and will reach 462 rand per ton by 2035. But most emitters benefit from generous tax-free allowances, which significantly reduce their effective carbon costs. These concessions have been retained for much longer than originally anticipated. Once the government phases out allowances and raises the tax rate, compliance entities will face steadily increasing carbon costs.

How it works

The levy covers direct greenhouse gas emissions for entities with thermal capacities of above 10 megawatts. Agriculture, forestry and waste are among sectors not yet liable to pay for their emissions. Nonetheless, South Africa’s levy ranks among the highest in the world for carbon taxes and markets in terms of share of jurisdiction emissions covered

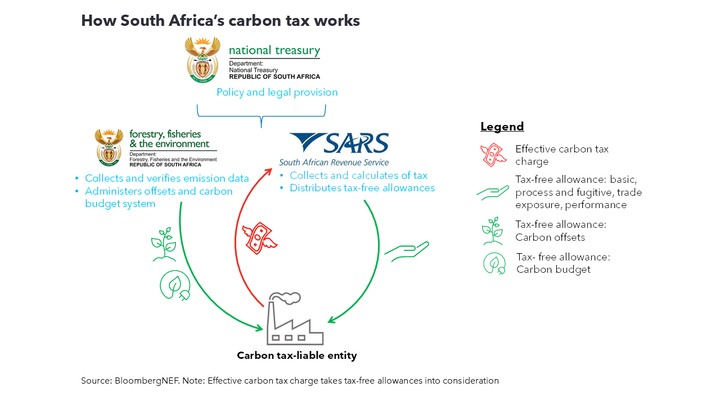

The carbon tax is designed by the National Treasury and is administered by the South African Revenue Service (SARS) alongside the Department of Forestry, Fisheries and the Environment. The revenues raised go to the National Revenue Fund – the central government fund established by the constitution. They are then recycled back to low-carbon projects and energy-efficiency improvements, as well as financing public transport infrastructure and electricity access to low-income households. Policymakers also use carbon tax revenue to raise funding for clean-energy incentives, to raise awareness of climate issues and further decarbonize the economy.

South Africa’s tax rose to 236 rand per ton in 2025, from 190 rand per ton in 2024, and is set to reach 462 rand per ton by 2035. This price level is lower than most other carbon taxes and markets in the world. The 2035 level of 462 rand per ton is also set below the estimated carbon price of $63-127 per ton needed to limit global warming to 2C above pre-industrial levels, based on recommendations by the World Bank’s High-Level Commission on Carbon Pricing, adjusted for inflation.

South Africa’s tax-free allowances and use of carbon offsets mean that companies pay much less than the official rate for their emissions – between 6 and 47 rand per ton in 2025. In Phase 1 (2019-2025), almost all companies could pay the carbon tax on as little as 5% of their emissions. Eskom, the state-owned utility, has also faced negligible carbon taxes due to credit provided for the electricity generation levy – a tax on electricity produced by non-renewable or toxic sources – as well as the renewable energy premium – a tax credit provided to users of renewable electricity sources. More information on the offsets scheme for South Africa’s carbon tax can be found in this dedicated factsheet.

Types of allowances

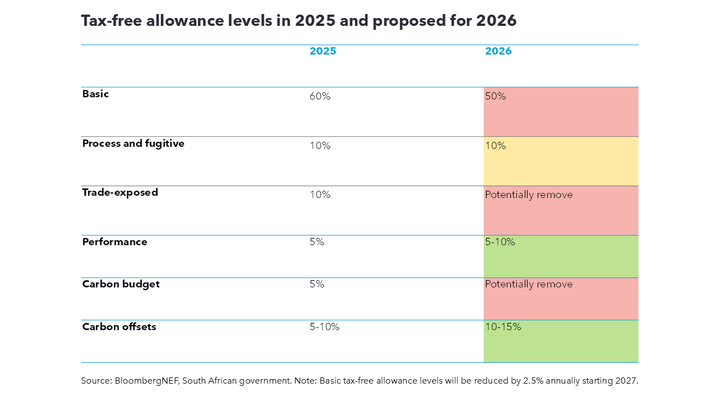

Several types of tax-free allowances, or rebates, are provided to those subject to the carbon tax.

-

Basic tax-free allowances are provided for fuel combustion. It is provided across most sectors to allow for the gradual phasing in of compliance.

-

Allowances for process and fugitive emissions are given to all manufacturing sectors that produce emissions during an industrial process, rather than the burning of fossil fuels, or due to unintended leaks and losses.

-

Trade-exposed sectors are given allowances to support competitiveness.

-

Performance allowances are provided to entities who have reduced their emissions intensity, calculated against greenhouse gas intensity benchmarks for specific sectors and sub-sectors.

-

Carbon budget allowances are provided to companies participating in the Department of Forestry, Fisheries and the Environment’s carbon budgeting system in Phase 1. This is a government program that sets a cap on greenhouse gas emissions of a sector or company over a specific period.

However, the government has signaled its intention to pull back tax-free allowances in Phase 2 (2026-2035) after it extended its soft transition period from end-2022 to end-2025 to allow more time for compliance entities to adjust and prepare for more stringent pricing. The electricity generation levy will also be replaced by a carbon tax from next year, albeit with up to 85% of the emissions covered by tax-free allowances.

The waste and agriculture, forestry and land-use sectors could become liable for the carbon tax from 2026. The government may also expand coverage within already covered sectors such as transport. The carbon price level will also be adjusted based on Consumer Price Index movements.

Stay up to date

Sign up to be alerted when there are new Carbon Knowledge Hub releases.