Lifecycle of a carbon offset

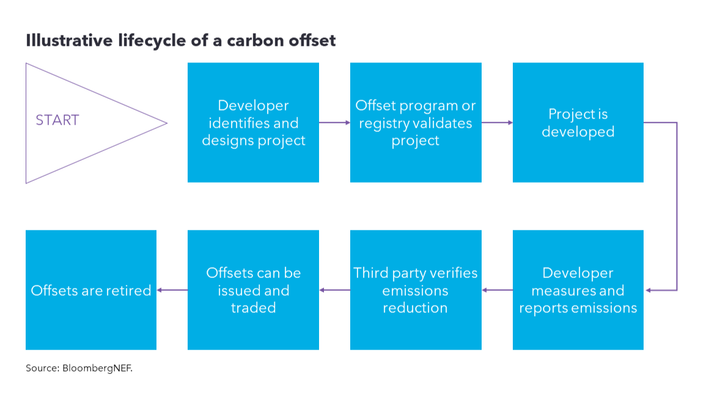

Though companies typically purchase and retire offsets toward a sustainability goal after a project has been completed, the lifecycle of a carbon offset goes back far earlier. Developers of carbon offset projects need to go through six key steps prior to the issuance of offsets. Even then, an offset can change hands several times prior to retirement.

Key message

Carbon offset projects need to go through six key steps, as follows: first, design and development of a project according to a selected registry standard. Second, verification and certification of project to be listed on a carbon registry. Third, project development and implementation. Fourth, measurement and verification of credits. Fifth, issuance of credits. Sixth, retirement of credits. After the project is listed on a registry, it must go through regular measurement, monitoring and verification process throughout its crediting period.

Project identification and design

As with any construction or infrastructure project, developers need to conduct feasibility studies and secure the necessary permitting for a project. For physical assets like energy generation, this means identifying a location. For projects like clean cook stove distribution, it means selecting a target community.

Developers need to adhere to an offset project methodology or protocol, which determines the rules on setting an emissions baseline and calculating reductions. In some cases, if there is no approved methodology for a given project type, developers can submit a new methodology for approval to the offset program such as the Clean Development Mechanism or a registry.

After identifying a project, developers need to put together a plan for building it, proving its additionality and monitoring of emissions. Developers require external stakeholder approval during this step, working with local communities tied to the project and often hiring third-party consultants to make sure they are fully prepared for validation.

Validation and registration

Before any further work can be done, a carbon offset project must receive validation from the carbon offset program or, in the case of the voluntary market, one of the main registries. This is arguably the most crucial component of the voluntary carbon offset value chain. Each offset has a serial number and these registries serve as a way of tracking and validating the quality of each offset produced, giving the sector a much-needed legitimacy boost. There are four primary registries that oversee most issuance activities in the voluntary carbon market:

-

Verified Carbon Standard (VCS): VCS is the largest global registry in the voluntary market and certifies carbon offsets, called verified carbon units (VCUs). VCS covers the widest range of project sectors, and oversees global projects.

-

Climate Action Reserve (CAR): Like VCS, CAR verifies offsets, called climate reserve tonnes (CRTs), based on a similar set of principles, including additionality, measurability, and transparency. Unlike the other major registries, CAR only verifies North American carbon offset projects.

-

Gold Standard (GS): Founded by the World Wildlife Fund, GS aims to align credit verification with the Paris Agreement and the 17 Sustainable Development Goals established at the 2015 United Nations General Assembly. GS lists projects on a global scale, but does not have any avoided deforestation projects on its registry.

-

American Carbon Registry (ACR): Operating in both voluntary carbon markets and California’s regulated carbon market, ACR was the first carbon registry created in the US and certifies offsets known as emission reduction tonnes (ERTs).

This step means a project meets a registry’s checklist of criteria, proving it can consistently produce high-quality carbon offsets. This is often the stage at which a developer looks to secure financing for its project, either through an emissions reduction payment agreement with a buyer, or through third-party funding.

In some sectors such as agriculture, smaller developers may list their offsets off-registry, by working with companies that provide an off-registry marketplace and compensate farmers directly and sell offsets through some other method, such as blockchain. There are also groups like the Integrity Council on Voluntary Carbon Markets (ICVCM) that are creating their own verification criteria to assess a project’s quality. This is complementary to the work done by registries.

Project development

After receiving validation from a registry and securing financing, project developers are free to begin implementing their projects. Depending on the sector, this can mean very different things. For physical projects like energy generation, it means construction, but it could also mean purchasing technologies to install for fugitive-emissions capturing or buying clean cook stoves to distribute.

In most cases, these companies develop projects specifically intended to avoid or remove carbon emissions. However, many of the largest project developers do not specialize in carbon offsets and instead are using the revenue to fund modifications to their existing assets, and this leads to questionable additionality.

This is often the case with sectors like clean energy – project developers will have signed a power purchase agreement (PPA) to get the revenue certainty they need to secure financing and are registering their project to sign offsets for secondary, or even tertiary, revenue.

Measurement, reporting and verification

Though a project developer submits an estimate of the project's annual issuance capacity, it needs to measure actual issuance after development to verify offsets via registries. For sectors like energy generation or emissions, this is a simple task which involves installation of a meter or sensors. For others, like reducing emissions from deforestation and forest degradation (known as REDD+), it may involve satellite imagery or flying over a site to measure progress.

After measuring and reporting on the number of offsets a project has produced, a third party is required to verify that the volume is accurate and that the quality of the credits has been upheld. Verification is the final step prior to issuance of an offset. Once verified, an offset is deposited in a project developer’s account on one of the registries and it is free to be issued directly to buyers or brokers, or be listed on an exchange.

Issuance and trading

The verification report goes to the program or registry for certification and issuance when offsets are transferred to the account of the project developers. Though offsets can be retired as soon as they are issued, in reality, they often sit in a developer’s account for an extended period and can change hands many times prior to retirement. They may be sold directly to a company, which uses them to meet its voluntary environmental, social and governance (ESG) target, or for compliance with an emissions trading program or tax. Alternatively, they could be sold to a broker, trader or aggregator. Offsets can also be sold multiple times through the secondary market until they are retired, or canceled from the market.

The wide range of countries and sectors, coupled with the opacity of pricing methodologies, means purchasing carbon offsets is not always straightforward. Many buyers rely on brokers to help with their carbon offset purchases as a result, rather than contracting them through an exchange or going directly to a developer.

Retirement

A carbon offset’s journey comes to an end once a company decides to retire it towards a sustainability target, meaning it cannot be traded again. Each registry has slightly different processes for retiring offsets, and only companies with an account for that registry can retire them. Once an offset has been retired, it is taken out of circulation.

Stay up to date

Sign up to be alerted when there are new Carbon Knowledge Hub releases.