Contracting options for offsets

intermediate

|

18 Oct 2024

Buyers can contract for carbon offsets in a number of ways – the most suitable option depends on the purchaser’s desired engagement with the project, offset demand, level of experience in offset trading and views on additionality.

Key message

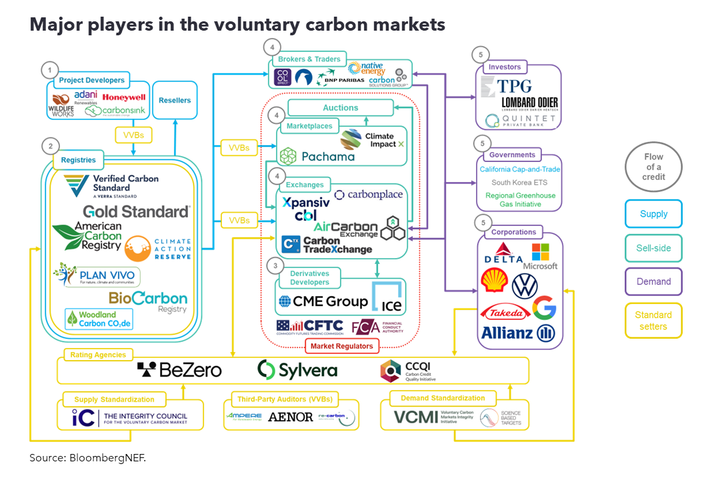

The most common way to contract offsets is via a broker, but some buyers may prefer to work directly with a project developer through an over-the-counter transaction. As the voluntary carbon offset market grows and involved parties work to improve its legitimacy, companies can also expedite their offset purchases through an exchange.

When

Offsets may be sold at any point during a project's crediting period, or prior. Some developers look to agree sales early on through forward contracts to lock in the price and secure financing for the project. For example, a prospective buyer could support the development of a project by agreeing to buy a specific amount of credits at a pre-defined price over a period of time in the future.

Other buyers wait until the offsets are generated, certified and issued before undertaking spot market sales. Regardless of when the sale occurs, developers are generally only paid once the offsets have been delivered, although advance payments are possible.

The price of an offset will mostly depend on project type, with removal credits trading at much higher prices than those generated by avoidance projects. However, contract terms could play a role. For example, offsets may be more expensive if the emission reductions are guaranteed, meaning they have either already occurred or will in the near future. In such a case, the seller may be liable for contract default if they fail to deliver the agreed units.

Brokers and traders

Over-the-counter transactions between brokers and buyers are the most common contracting method. In most cases, brokers will bring a list of projects to a customer, purchasing offsets and retiring them on the customer’s behalf. They also occasionally pre-purchase offsets directly from developers and then sell them to customers at a later date for a premium. Buyers can specify criteria like the amount of offsets they want to purchase, as well as the sectors and regions they want to buy from. While this can be a timely process, it saves the buyer due-diligence and the effort of sourcing offsets that meet necessary criteria. Most brokers’ business models include an extra per-unit charge on each offset purchased, meaning contracting for offsets through a broker is the most expensive route – even more so than going directly to a developer.

Though more complicated, buyers can invest directly in a project, claiming a portion of the offsets as they are produced and potentially saving on transaction fees. For purchasers that place extra emphasis on additionality and marketing emission reductions to their stakeholders, direct investment can lead to deeper engagement with a project.

Marketplaces

Another option is to purchase from an aggregator or market places. Unlike a broker, these intermediaries purchase and take ownership of offsets from small suppliers to sell them at a more competitive rate to brokers or buyers. This approach is suitable for buyers looking to purchase only a small volume of offsets, although they may only have access to basic information on the projects. Aggregators have accounts on registries and can retire the offsets directly on behalf of buyers. They are most common in sectors like agriculture where the projects that produce offsets are smaller and don’t have the balance sheets to begin generating credits on their own.

Exchange

The fastest and perhaps least involved process involves contracting offsets through a commodity exchange. Developers and brokers can list their offsets on an exchange for anyone to buy, though once listed these offsets cannot be sold elsewhere. While exchanges do give developers additional exposure, they typically charge a commission fee on each sale, which can drive up prices.

Besides being traded individually, carbon offsets can be traded as standardized contracts. These are tradable security from a bundle of offsets fulfilling criteria. Currently, the voluntary market is moving toward becoming a commodity market. This is a much-needed step to support the large future demand for carbon offsets as governments and companies use them to achieve their net-zero goals. In particular, the market will need to move away from the current system of over-the-counter transactions between projects and buyers, to infrastructure that supports instantaneous and high-volume trade. The value chain will therefore be entirely different, focused more on exchanges, marketplaces, derivative products and universal definitions around quality.

Future purchase agreements

Alternatively, companies can lock into a multi-year contract for a set amount of offsets through an emission reduction purchase agreement, or ERPA, similar to a power purchase agreement (PPA) in energy markets. The long-term revenue certainty of an ERPA generally gets buyers access to cheaper offsets from a project because it helps that project developer secure financing.

Stay up to date

Sign up to be alerted when there are new Carbon Knowledge Hub releases.