Carbon credits could return to EU's carbon market

intermediate

|

21 Aug 2025

This factsheet is an extract from BloombergNEF's EU ETS Market Outlook 1H 2025: On the Brink of Change. To access this report, please contact sales.bnef@bloomberg.net.

The European Union’s Emissions Trading System (EU ETS), which seeks to reduce emissions across all EU countries as well as Iceland, Liechtenstein and Norway, has steered clear of allowing mandated entities to use carbon credits to fulfill part of their compliance obligations since 2021. However, the bloc’s carbon market could see removal credits – generated from projects that remove greenhouse gases from the atmosphere – reintroduced. This potential inclusion could exert downward pressure on the EU carbon price.

Key message

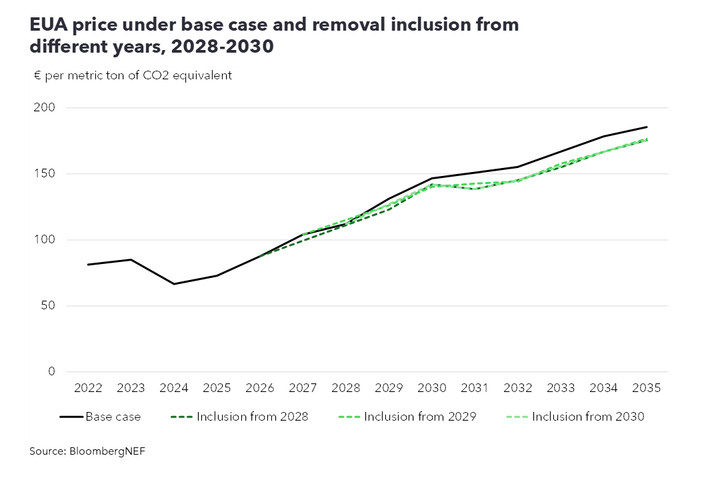

The EU Commission is considering the inclusion of carbon removal credits in its ETS, with a review scheduled for 2026. An approval could be bearish for the bloc’s carbon price, lowering it by 4-7% in 2035, relative to BloombergNEF’s base case. The cost of carbon removals and the year of inclusion will be the biggest determinants of the impact on the EU carbon price, relative to current policy settings.

Carbon credits on the table for the EU ETS

A review relating to the inclusion of carbon removals in the bloc’s carbon market – scheduled for 2026 – could see carbon credits return to the EU ETS. This would be the first time carbon credits are allowed in the scheme since 2021.

Leading up to the review, important questions relating to the sources and types of carbon removals need to be addressed. Currently, the Industrial Carbon Management Plan – published by the European Commission in February 2024 – does not include nature-based, non-permanent removals such as reforestation and agriculture. Only industrial carbon removal, such as direct air capture (DAC) and bioenergy with carbon capture and storage (BECCS), are considered. The EU has proposed a similar rule – allowing domestic permanent removals in the ETS – to reach its 2040 climate target.

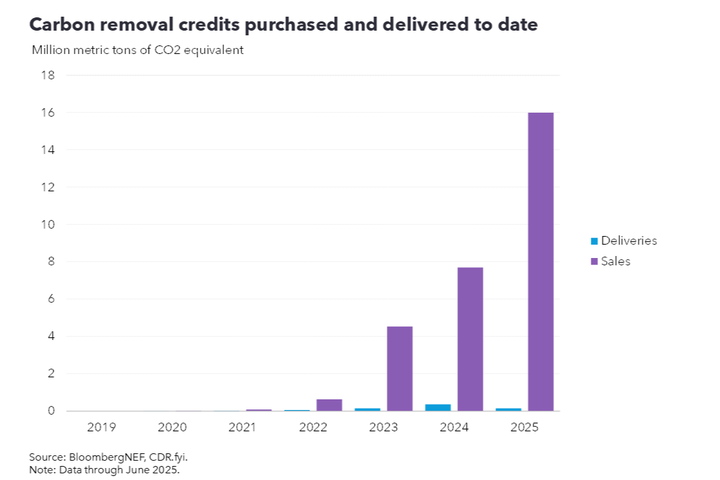

Additionally, it remains unconfirmed whether carbon removal credits from outside the EU will be accepted, or whether projects must be EU-based. The latter could severely limit an already constrained supply pool. Removals constituted just 3% of carbon credits listed on the four main international registries in 2024, and all of these are from projects based outside the EU. Upfront purchases of 29 million carbon removal credits – to be delivered at a later date – have been made globally between 2019 and 2025 through offtake agreements, but only 0.79 million has been delivered so far.

Inclusion of carbon removals may be bearish for EU carbon price

The inclusion of carbon removals could put downward pressure on EU carbon prices for two reasons. First, it will add more supply to the market. And second, some of the included technologies, such as BECCS, are cheaper than other forms of carbon abatement in the bloc. If removals are included from 2030, BloombergNEF forecasts that EU emissions allowance (EUA) prices could drop to €142 ($160) per metric ton in that year, compared with €147 per ton under BNEF’s base-case scenario, which reflects current policy settings.

This decline is projected to be more substantial if removals are introduced post-2030, as with each passing year the available capacity of DAC and BECCS is expected to increase. If the inclusion takes place in 2031 or 2032, EUA prices could average €151-€154 per ton between 2031 and 2035. This is significantly lower than the forecast price of €167 per ton in BNEF’s base-case scenario.

Additionally, including carbon removals in the bloc’s carbon market could channel much-needed financing toward carbon removal technologies, in turn lowering the cost of these projects. With reduced costs, more supply could be added to the EU ETS and trigger further drops in the carbon price.

Stay up to date

Sign up to be alerted when there are new Carbon Knowledge Hub releases.