Designing a compliance market for an emerging market

intermediate

|

26 Sep 2024

Designing a compliance market for an emerging market

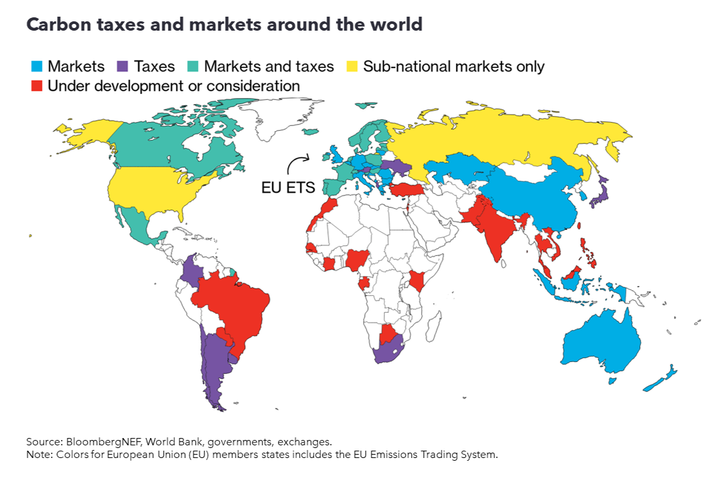

Carbon pricing is gaining momentum around the world as it can often create least-cost market-based solutions for emissions abatement. But a government of an emerging market faces the challenge of introducing a carbon price while still enabling economic growth and meeting the needs of the population. It may also require new capabilities and systems to be implemented as a prerequisite.

Key message

A country first needs to build the capabilities and systems to measure, report and verify emissions and it could then promote the development of a voluntary carbon market before transitioning to a compliance scheme. Designing these programs will require policymakers to take account of the impact on the emerging economy and the livelihood of low-income households that tend to be most impacted by the pass-through of carbon prices onto everyday purchases. The structure, flexibility mechanisms and price controls implemented may require some customization.

First voluntary then compliance

Before a compliance carbon market can be implemented in an emerging market, the government needs to build the capabilities and systems to measure, report and verify (MRV) greenhouse-gas emissions. These ensure accounting processes are robust and emissions reductions are real. As such, policymakers may opt to use this infrastructure and construct a voluntary market framework, to encourage companies to introduce their own MRV systems and become familiar with carbon trading. This should then facilitate the transition to a compliance market at a later stage. This approach is being used in several emerging markets such as India.

Type of cap

The most common type of compliance market is a cap-and-trade scheme, which can have an absolute emissions cap, as implemented in Europe and California, or an intensity-based cap, as in China’s national emissions trading program. An absolute cap limits the overall volume of emissions permitted within each compliance period, while an intensity-based cap limits the volume of emissions per unit of output such as GDP or ton of raw material.

As explained in this factsheet, policymakers may prefer an absolute cap because it is meant to deliver a guaranteed reduction in emissions. However, intensity-based caps may suit emerging markets as they allow more flexibility and accommodate economic growth. Such markets may also start with an intensity-based cap and then slowly transition to an absolute limit.

Sectors to target

Most carbon markets begin by covering a limited portion of the economy before slowly expanding their reach. At first, governments generally target sectors that:

-

Make up a large portion of the jurisdiction’s carbon footprint

-

Comprise a limited number of entities that are responsible for emissions

-

Have economical options for decarbonization.

China’s national emissions trading scheme first only covered the power sector, which fulfills all three requirements. This is not always the case. Transport accounts for a growing share of emissions in Europe, yet the region’s emissions trading scheme did not include the sector. This spurred some member states like France and Germany to implement national carbon pricing programs to tackle road transport, and the EU’s Emissions Trading System II, which includes this sector, kicks off in full from 2027. For most emerging markets, sectors such as electricity, heat and transport are likely to make up a large portion of the emissions and may be good options to include in a compliance market.

Equity

A crucial consideration for policymakers is to assess the overall policy context, impacts of a carbon price on the general population, and how equitable these effects will be across all demographics. Read more about public acceptance of such policies.

Carbon prices may be regressive as they disproportionately affect lower-income households that spend a greater percentage of their income on electricity, fuel and transport. This issue is all the more pertinent for emerging markets, because poorer countries often have less developed mechanisms for effective redistribution. Government revenues from carbon prices or taxes in developed countries can often be redistributed to lower-income households through direct rebates or tax adjustments. This cannot be easily implemented in emerging markets as a large informal economy may mean governments have limited information on actual household incomes.

In addition, policymakers should assess whether a carbon price could shift consumers toward alternative technologies and solutions that may cause greater environmental damage and may not be regulated. For example, a carbon price baked into electricity or gas prices could push households in an emerging market to burn firewood for heating, which would be counterproductive and create greater health-related problems. Carbon markets in emerging economies will need to be designed taking in to account second- and third-order effects such as this to ensure actual carbon reductions while being equitable for all.

Mechanisms to control prices

The vast majority of fully fledged cap-and-trade programs incorporate mechanisms to help control the market and avoid shocks. There is always a risk of market shocks as it is challenging to forecast emission trajectories accurately and the fixed cap – at least in absolute-based systems – cannot automatically respond to changes in the supply-demand balance. Governments may also implement control mechanisms to avoid overly high or volatile prices, especially in more controlled (rather than free market) economies. In emerging markets, where industries and consumers may be more sensitive to prices, such control mechanisms can help bring some stability and certainty on costs associated with carbon abatement. Read more about market stability mechanisms.

Mechanisms to give participants flexibility

Along with control measures, governments often incorporate flexibility mechanisms into their carbon pricing policies to reduce the compliance burden and ensure companies can remain competitive in the international arena. This is especially common in the early stages of a program, but they can be continued in the longer term to protect against carbon leakage. Emerging markets often have industries that operate on thin profit margins and hence special arrangements may need to be made for such industries.

Flexibility mechanisms can take various forms. Most cap-and-trade schemes include some free allocation of permits, and many carbon markets and some taxes allow participants to comply by submitting offsets . Another form of flexibility is banking and borrowing of permits.

Stay up to date

Sign up to be alerted when there are new Carbon Knowledge Hub releases.