Corsia carbon credits turn costly

intermediate

|

26 Jun 2025

This factsheet is an extract from BloombergNEF's Aviation Credits Market Outlook: Corsia Gets Its Wings. To access this report, please contact sales.bnef@bloomberg.net.

A United Nations-led carbon market has taken center stage in the efforts to decarbonize the aviation industry. Under the Carbon Offsetting and Reduction Scheme for International Aviation (Corsia), airlines are required to reduce their emissions from global passenger and cargo flights between member states relative to 2019 levels. If not, participants must either purchase low-carbon fuels or use Corsia-eligible carbon credits equivalent to their excess emissions. The high price point of the former means airlines could rely more heavily on carbon credits, pushing up their prices significantly and raising the bar for good quality carbon credits in other markets.

Key message

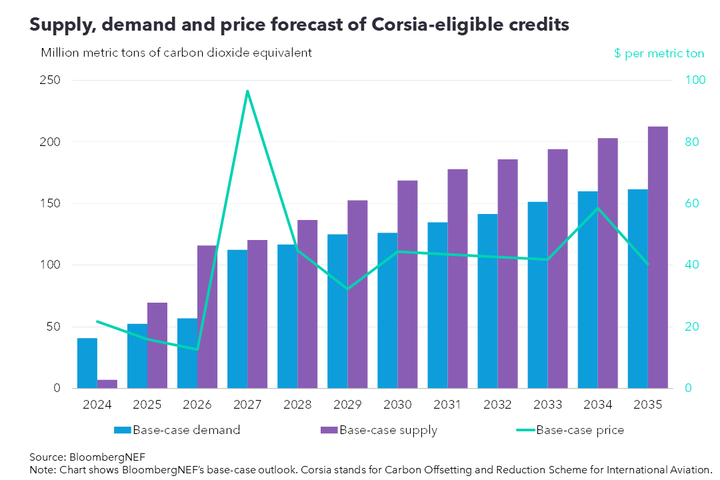

Airlines participating in the United Nations-led Carbon Offsetting and Reduction Scheme for International Aviation (Corsia) could be looking to procure eligible carbon credits to fulfill their compliance obligations. BloombergNEF forecasts that the prices of such credits could more than quadruple, peaking at $97 per metric ton in 2027 in its base-case scenario. For some airlines, purchasing carbon credits to comply with Corsia could end up making up a significant amount of their operating expenses.

Eligible carbon credit prices to surge

Both options that participants could use to comply with Corsia are expensive. Currently, sustainable aviation fuel – a low-carbon replacement to traditional jet fuel – costs $570 per metric ton of carbon dioxide equivalent. Comparatively, Corsia-eligible carbon credits averaged $21.70 per ton in auctions held in 2024.

However, BloombergNEF forecasts that carbon credit prices will increase rapidly and reach $97 per ton by 2027 in its base-case scenario. This is mostly attributed to a 98% surge in annual carbon credit demand with the start of the second phase of Corsia (2027-2035). During this period, all members of the International Civil Aviation Organization – including major markets such as China, India and Russia – are mandated to participate in the aviation carbon market. As more supply is introduced in the subsequent years, closing the gap with demand, prices are set to taper off. In the final year of Corsia, carbon credits could cost $40.40 per ton.

Not all airlines will be affected equally

BNEF projects that airlines would need to spend up to $62 billion cumulatively on carbon credits from 2024 to 2035 to comply with Corsia. However, the cost is not shouldered equally by all airlines, as the top emitters – Emirates, Qatar Airways and United Airlines – are disproportionately affected by the aviation carbon market. The three companies accounted for 14% of total estimated emissions covered under Corsia, led by Emirates. The Dubai-based airline could spend up to $3.7 billion on carbon credits, based on BNEF’s estimates. This could trickle down to customers in the form of more expensive tickets and may lead to pushback from airlines and some host countries.

Stay up to date

Sign up to be alerted when there are new Carbon Knowledge Hub releases.