Carbon credit demand sources diversify

intermediate

|

28 Apr 2025

This factsheet is an extract from BloombergNEF's Long-Term Carbon Credit Demand Outlook 2025. To access this report, please contact sales.bnef@bloomberg.net.

Historically, carbon credit demand was derived primarily from corporations to fulfill their climate targets. But demand sources have since diversified as more channels have emerged in recent years. Regulated markets are increasingly allowing the use of carbon credits as part of their compliance obligations and country-to-country carbon credit trading is gradually being formalized under a United Nations framework. These “off-ramps” for carbon credits are becoming more interconnected and credit fungibility is currently one of the hottest topics in the market.

Key message

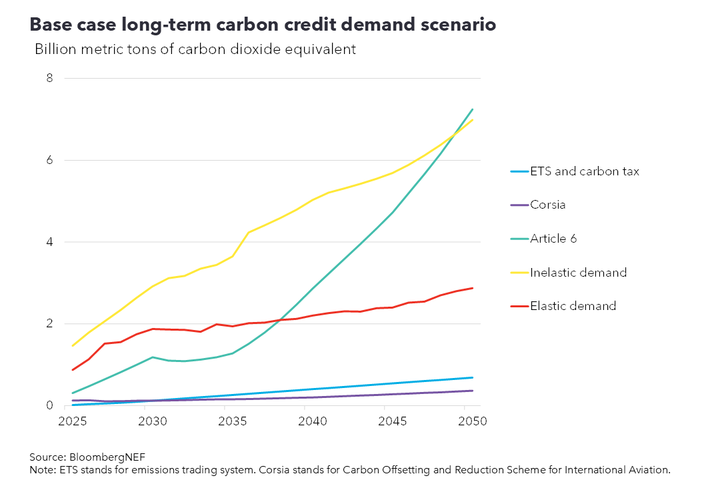

More carbon credit demand sources have been established as the market develops. BloombergNEF estimates that country carbon credit demand under the “Article 6” framework could be the largest channel in 2050, reaching 7.2 billion metric tons of carbon dioxide equivalent (GtCO2e). Although regulated corporate demand is projected to be the smallest among all these markets, it remains a reliable source that will provide consistent demand.

Elastic voluntary corporate demand

Despite a bumpy few years where demand has flatlined due to media scrutiny and a series of controversies relating to major carbon projects, BloombergNEF projects that corporations could still prove to be a large source of carbon credit demand in the long term. The question is how large, with some of its scenarios reaching 7GtCO2e in 2050 if quality concerns in the market are addressed. However, its elastic voluntary corporate demand scenario – which accounts for corporate willingness to pay and is the most likely to occur – will reach just 1.9GtCO2e in 2030 and peak at 2.9GtCO2e in 2050. Companies will be reluctant to voluntarily procure low-integrity carbon credits that could pose reputational risks. Without penalties or binding obligations, companies could be less incentivized to offset their emissions using credits.

Regulated corporate demand

Carbon pricing mechanisms, including emission trading systems (ETS) and carbon taxes, as well as new regulated schemes such as the Carbon Offsetting and Reduction Scheme for International Aviation (Corsia) could collectively add 1.1GtCO2e worth of reliable, inelastic demand to carbon markets in 2050. This would come on top of voluntary corporate demand, discussed above.

More than 30 national and subnational carbon pricing mechanisms are in force as of March 2025 allow carbon credits to be used as part of their compliance obligations. Airlines and aircraft operators that are mandated to participate in Corsia could also use eligible carbon credits to meet their baselines, in addition to using low-carbon fuels like sustainable aviation fuel. Although much smaller than voluntary corporate demand, these regulated carbon markets provide a consistent flow of legally obligated buyers with strong incentives to procure carbon credits.

Article 6 demand

In addition to company-driven carbon credit demand, countries are a newfound source of demand that could grow substantially. The Paris Agreement’s Article 6 framework creates a market for governments to achieve their Nationally Determined Contributions, or country emissions targets, using approved carbon credits. More than 60 country-to-country carbon agreements have been announced under Article 6.2, where some countries such as Sweden have bought carbon credits from seller markets like Ghana. Country demand for carbon credits under the Article 6 mechanism could reach 7.2GtCO2e in 2050. This is the largest among BNEF’s base-case scenarios. But to maximize this potential, more clarity around definitions and environmental integrity is still needed.

Stay up to date

Sign up to be alerted when there are new Carbon Knowledge Hub releases.